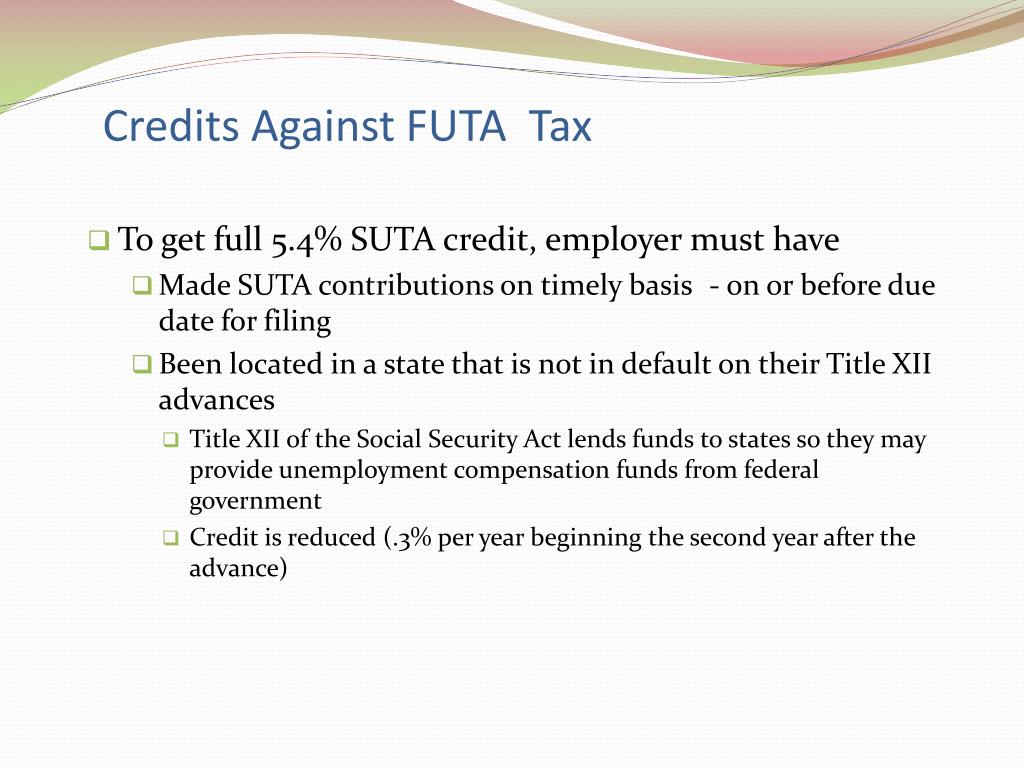

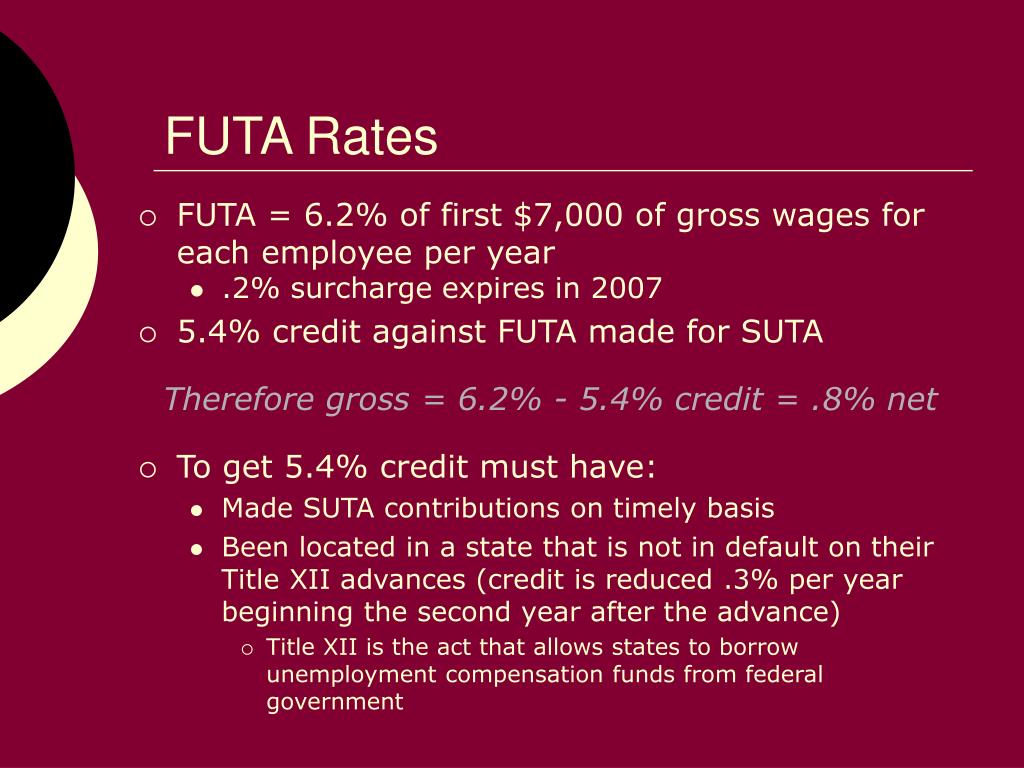

Futa Rate 2025. However, most employers receive a credit of up to 5.4% when. The futa tax rate protection for 2022 & 2023 is 6% as per the irs standards.

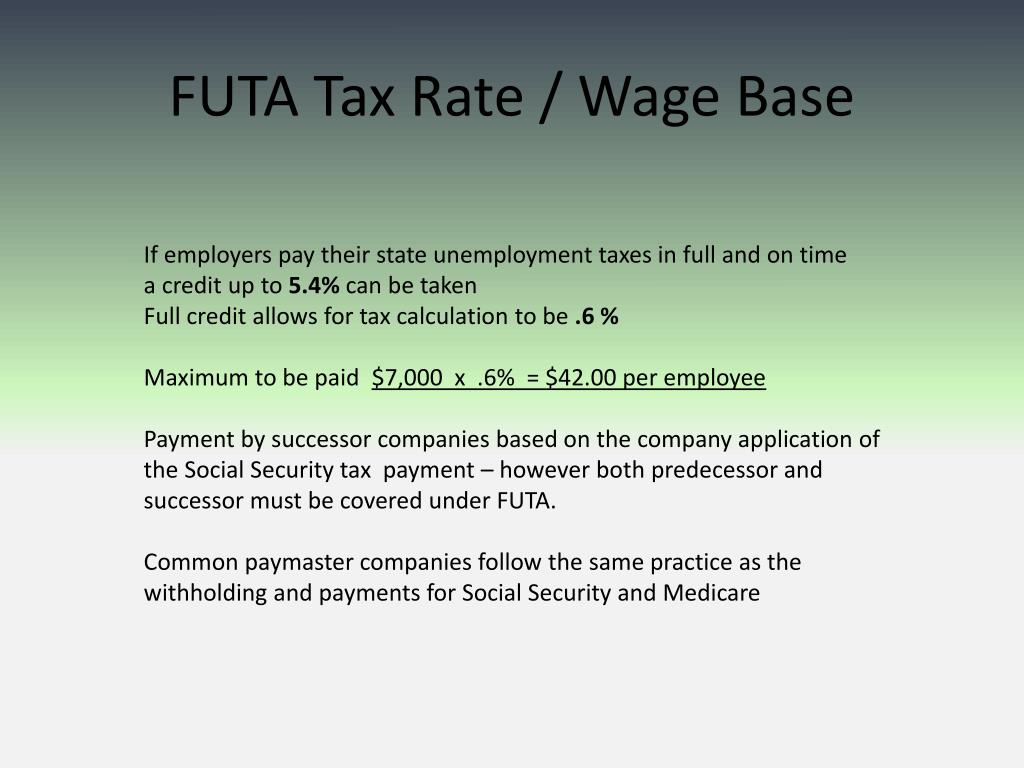

The futa tax rate is 6% of the first $7,000 paid to each employee annually. The futa tax rate is 6.0%.

The Federal Unemployment Tax Act (Futa) Is A Tax That Employers Pay To The Federal Government.

The futa tax rate is 6%.

However, Most Employers Benefit From A 5.4% Futa Credit, Resulting In A Futa Rate Of 0.6% On The First $7,000 In Wages Per.

India’s inflow of such remittances is forecasted to grow at 3.7% in 2024, while it grew at 7.5% in 2023.

The Federal Unemployment Tax Act (Futa) Is A Federal Law That Requires Businesses To Pay Annually Or Quarterly To Fund Unemployment Benefits For Employees.

Images References :

Source: www.fundera.com

Source: www.fundera.com

What Is FUTA Tax Tax Rates and Information, The default futa tax rate in california is 6%, but employers are provided a credit of 5.4%, resulting in a net rate of 0.6%. Futa tax rate (2022) and tax credit eligibility.

![[Solved] Compute FUTA & SUTA Tax Payroll SUTA Ra SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2023/04/643fea05c339d_1681910277557.jpg) Source: www.solutioninn.com

Source: www.solutioninn.com

[Solved] Compute FUTA & SUTA Tax Payroll SUTA Ra SolutionInn, The growth estimate for 2025 is 4%. The futa tax rate is 6% of the first $7,000 paid to each employee annually.

Source: www.slideserve.com

Source: www.slideserve.com

PPT CHAPTER 5 PowerPoint Presentation, free download ID6794591, Futa tax rate (2022) and tax credit eligibility. India received $120 billion in.

Source: seyyedsimbiat.blogspot.com

Source: seyyedsimbiat.blogspot.com

Futa employer tax rate SeyyedSimbiat, What is the futa tax rate? However, most employers receive a credit of up to 5.4% when.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

What is FUTA? Definition & How it Works QuickBooks, What is the futa tax rate? The current futa tax rate is 6.0% on the first $7,000 of wages paid to each employee during a calendar year.

Source: www.preps.ng

Source: www.preps.ng

FUTA School Fees Schedule 2024/2025 Everything You Need To Know, The futa tax rate is 6% of the first $7,000 paid to each employee annually. Employees are not required to pay the futa tax or have it deducted from.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Unemployment Insurance PowerPoint Presentation, free download, Generally, employers receive a credit of 5.4% when they file their form 940, employer’s annual federal unemployment (futa) tax return, to result in a net futa. The current federal unemployment insurance tax rate is 6% and applies to the first $7,000 paid to each employee (called.

![FUTA Rate Increases for California [Infographic]](https://blog.accuchex.com/hs-fs/hubfs/ui_tax_increases.jpg?width=1280&height=1920&name=ui_tax_increases.jpg) Source: blog.accuchex.com

Source: blog.accuchex.com

FUTA Rate Increases for California [Infographic], The futa rate is 6.0% (before state tax credits) of what you paid an employee during the quarter. Employers should file their futa.

Source: onpay.com

Source: onpay.com

What is the FUTA Tax? 2024 Tax Rates and Info OnPay, After an employee surpasses $7,000 in income, the employer can stop paying futa tax on them. The growth estimate for 2025 is 4%.

Source: www.slideserve.com

Source: www.slideserve.com

PPT CHAPTER 5 PowerPoint Presentation, free download ID7075332, The futa tax applies to the first $7,000 in wages you pay an employee throughout the calendar. As of 2022, the futa tax rate is 6.0%, applied to the first $7,000 paid toward each employee’s wages throughout the year.

The Futa Tax Rate Is 6%.

The futa tax applies to the first $7,000 in wages you pay an employee throughout the calendar.

The Federal Unemployment Tax Act (Futa) Is A Tax That Employers Pay To The Federal Government.

The current futa tax rate is 6.0% on the first $7,000 of wages paid to each employee during a calendar year.