Irs Standard Business Mileage Rate 2025. Understanding the 2025 irs standard mileage rates. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025.

On december 14th, 2025, the irs announced the 2025 irs standard mileage rate as 67 cents. This represents a 1.5 cent.

The 2025 Medical Or Moving Rate Is 21 Cents Per Mile, Down From 22 Cents Per Mile Last.

Not all of the rates for 2025 will increase, however.

Each Year, The Irs Lets You Write Off A Standard Amount For Each Business Mile You Drive.

Mileage type rate / mile effective date end date;

Washington — The Internal Revenue Service.

Images References :

Source: timeero.com

Source: timeero.com

IRS Mileage Rate for 2025 What Can Businesses Expect For The, Irs reimbursement rate for mileage 2025 livvy quentin, the 2025 medical or moving rate is 21. For the year 2025, the standard mileage rate for business travel has been increased to 67 cents per mile, up by 1.5 cents from the 2025.

Source: smallbiztrends.com

Source: smallbiztrends.com

IRS Announces 2025 Mileage Reimbursement Rate, Ultimate guide to mileage reimbursement in 2025: The irs has announced the standard mileage rate for 2025:

Source: www.youtube.com

Source: www.youtube.com

2025 IRS Standard Mileage Rate YouTube, The irs increased the optional standard mileage rate used to calculate the deductible costs of operating a vehicle for business to 67 cents per mile driven, up. The standard business reimbursement rate will be bumped up by 1.5 cents to 67 cents per mile, effective jan.

Source: financiallevel.com

Source: financiallevel.com

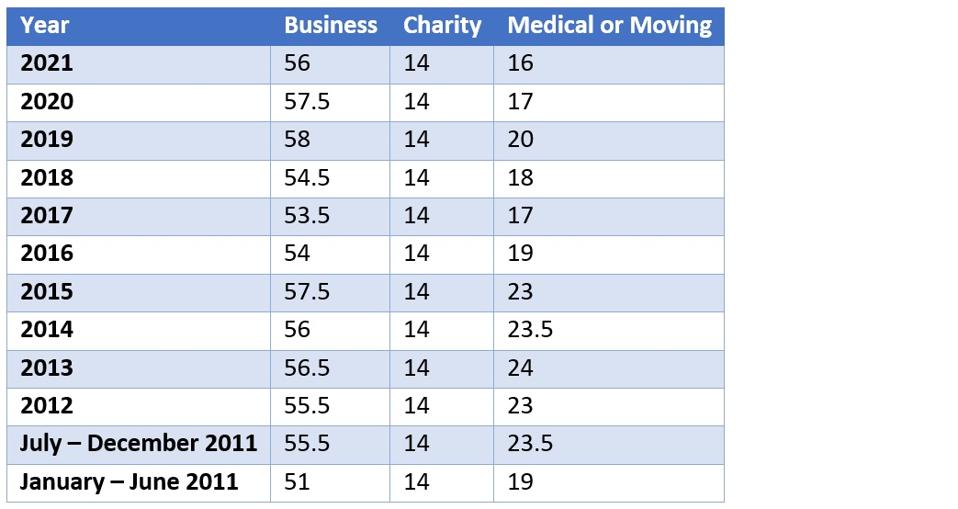

Table showing historical IRS mileage rates, On december 14th, 2025, the irs announced the 2025 irs standard mileage rate as 67 cents. Ultimate guide to mileage reimbursement in 2025:

.png) Source: timmyamerson.pages.dev

Source: timmyamerson.pages.dev

2025 Irs Business Mileage Allowance Maire Roxanne, Page last reviewed or updated: 15 dec 2025 18:40 est.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Irs Electric Vehicle Mileage Rates 2025 Annie, Page last reviewed or updated: The 2025 irs mileage rates have been set at 67 cents per mile to accommodate the economic changes over the past year.

Source: triplogmileage.com

Source: triplogmileage.com

How Is the Standard IRS Business Mileage Rate Determined?, Washington — the internal revenue service. Irs rates, rules, and best practices.

Source: www.pbktax.com

Source: www.pbktax.com

IRS Announces Standard Mileage Rate Change Effective July 1, 2022, Every year, the internal revenue service (irs) announces. Mileage type rate / mile effective date end date;

IRS Increases Business Mileage Rate For 2025, Every year, the internal revenue service (irs) announces. Irs rates, rules, and best practices.

Source: www.mybikescan.com

Source: www.mybikescan.com

2025 IRS Mileage Reimbursement Rate A 1.5 Cent Boost Explained, The 2025 medical or moving rate is 21 cents per mile, down from 22 cents per mile last. Not all of the rates for 2025 will increase, however.

Each Year, The Irs Lets You Write Off A Standard Amount For Each Business Mile You Drive.

Car expenses and use of the standard.

In 2025, The Standard Mileage Allowance Is $0.655.

Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.